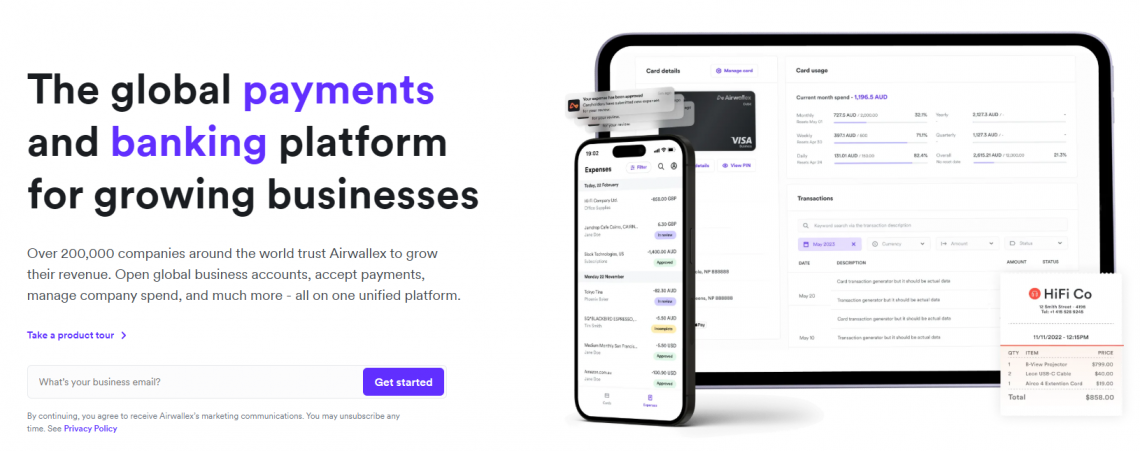

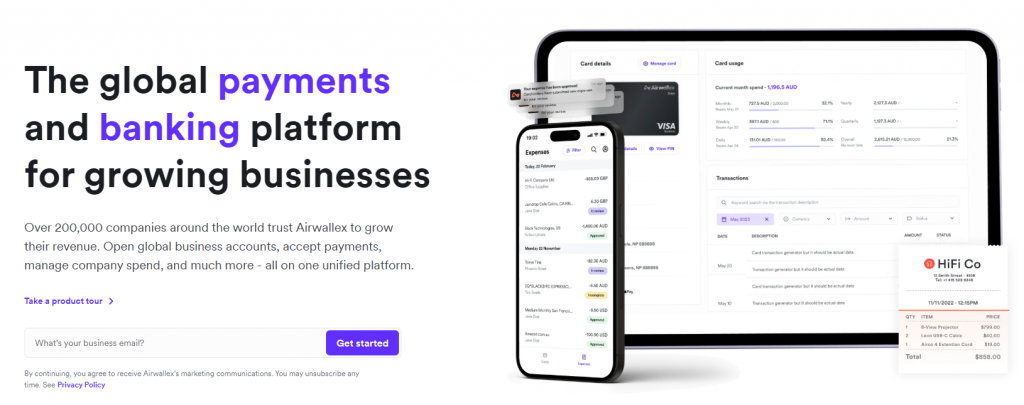

Airwallex Review: One Financial Platform Built for Global Growth

Traditional banking was never designed for global business. Slow transfers, hidden fees, and fragmented tools make scaling internationally expensive and inefficient. Airwallex was built to solve exactly this problem.

For U.S. businesses operating across borders, Airwallex delivers a modern financial infrastructure that replaces multiple banks and payment providers with one powerful, unified platform.

A Smarter Alternative to Traditional Business Banking

Airwallex gives businesses the ability to operate globally without opening multiple foreign bank accounts or dealing with complex intermediaries. Everything — payments, currencies, cards, and expenses — is managed in one secure dashboard.

This approach helps companies:

- Reduce operational friction

- Gain real-time visibility into global cash flow

- Eliminate unnecessary banking fees

- Scale faster with fewer financial limitations

For growth-focused businesses, Airwallex becomes an essential foundation rather than just another tool.

End-to-End Global Money Management

Multi-Currency Capabilities Without Complexity

With Airwallex, businesses can hold and manage multiple currencies simultaneously. This makes it easy to receive payments from international customers and pay overseas suppliers without constant currency conversions.

Funds can be converted when rates are favorable, giving finance teams greater control over margins.

Fast, Transparent Cross-Border Payments

Airwallex processes international transfers efficiently, minimizing delays and unexpected costs. Compared to traditional banks, payments arrive faster and with clearer pricing — a critical advantage for businesses managing tight cash cycles.

Corporate Cards Designed for Modern Teams

Airwallex corporate cards help businesses control spending at scale. Teams can issue cards instantly, set precise limits, and track usage in real time. This eliminates manual reimbursements and improves accountability across departments.

Virtual cards also enhance security for online transactions and subscriptions.

Powerful Tools for Finance and Operations Teams

Real-Time Expense Visibility

Every transaction is captured automatically, allowing finance teams to monitor spending as it happens. This reduces errors, improves forecasting, and simplifies monthly reporting.

Automated Billing and Invoicing

Airwallex supports automated invoicing and recurring billing, helping businesses get paid faster and reduce administrative workload. This is especially valuable for SaaS companies and service providers with subscription-based revenue.

Seamless Integration Across Business Systems

Airwallex fits easily into existing workflows by connecting with accounting, ERP, and e-commerce platforms. This reduces manual data entry and ensures accurate financial records at all times.

Exclusive Advantages for U.S. Businesses

Airwallex customers in the United States benefit from a range of cost-saving and growth-focused incentives that enhance the overall value of the platform.

Common advantages include:

- No ongoing monthly account fees

- Competitive foreign exchange pricing

- Access to partner discounts on essential business software

- Credits and promotions designed to support scaling companies

These benefits help businesses maximize return on investment from day one.

Trusted by Fast-Growing Companies Worldwide

Businesses across industries choose Airwallex because it delivers reliability, speed, and financial clarity.

Users frequently mention:

- Significant savings on international payments

- Improved control over global expenses

- A clean, intuitive user experience

- Responsive support for growing teams

For many companies, Airwallex replaces multiple financial tools and simplifies daily operations.

Who Airwallex Is Best For

Airwallex is ideal for:

- U.S. e-commerce brands selling internationally

- SaaS companies with global subscribers

- Agencies paying overseas contractors

- Startups preparing for international expansion

- Established businesses optimizing cross-border operations

Designed for the Future of Global Commerce

As global trade accelerates, businesses need financial infrastructure that can adapt. Airwallex combines advanced technology with global reach, giving U.S. companies the flexibility to expand into new markets without rebuilding their financial stack.

Final Thoughts: Is Airwallex Right for Your Business?

If your business is looking for a modern alternative to traditional banks, Airwallex delivers speed, transparency, and control.

It helps companies:

- Operate globally with confidence

- Reduce hidden fees and inefficiencies

- Simplify financial operations

- Focus resources on growth instead of administration

For U.S. businesses ready to scale internationally, Airwallex is a strategic choice that supports long-term success.